“I’m hoping an increase in interest rates will result in a decrease in home prices.”

I hear this type of statement often, so I put together the following example to try and illustrate what that might look like.

Example

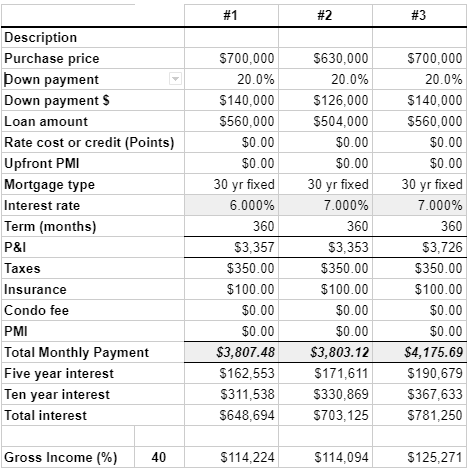

Let’s say you have the opportunity to purchase a home for $700,000 putting 20% down. That would mean you’d have a loan of $580,000. The table below shows three scenarios.

What if just the rates increases?

The first scenario is if you purchased using a 30 year fixed mortgage at 6%. The third scenario shows what it would cost if rates increased by 1% to 7% before you decided to buy. Your monthly mortgage payment would increase by $369 per month. With the rate increase over the first five years, you’d pay about $22K more in monthly payments and accrue $6K less in equity. That is a difference of $28K for a 1% rate increase! I won’t bother mentioning what it would mean if you kept the loan the whole 30 years…

What if prices come down?

In our current rate environment (6-7% range) it would take a decrease in sale price of 10% to equal a 1% increase in rate. This time we’ll compare Scenarios #1 and #2. Looking at Scenario #2, you can see that a 10% decrease in value and a 1% increase in rate brings the monthly payments in line with Scenario #1. But, over five years you’d still be paying $9K more in interest which means you’d accrue $9K less in equity. And, I don’t think anyone really wants to see real estate values decrease 10%?

One other consideration

One last thing to consider when comparing Scenarios #1 and #2 is that when you have an increase in rate your buying power decreases. A 1% increase in Scenario #3 means you’ll need to make approximately $11K in order to qualify.

The bottom line

Home prices would really have to take a hit in order to equal out even a small increase in rates. And, considering that we have an extremely low for sale inventory I don’t see that happening any time soon. A crystal ball would really be nice right about now.

I’m always available if you have any questions or just want to chat about real estate!